Over the weekend, the WSJ published an opinion piece titled "How Government Spending Fuels Inflation." The piece was written by Tunku Varadarajan, who summarizes arguments made by John Cochrane, an economist and senior fellow at the Hoover Institution.

This was an unfortunate piece, and is especially disappointing for an esteemed publication such as the WSJ. Like most mainstream economists, Cochrane confuses correlation with causation. He notes that federal debt has increased by 30%, then rhetorically asks "Is it at all a surprise, that a year later inflation breaks out?"

Statements like this may sound intelligent on their surface, but his assertions are in no way supported by facts. The below chart compares year-on-year percentage change in total federal debt with the year-on-year growth rate in CPI. There were similar percentage increases in total federal debt in 1983 and 2009. Notably, neither of those periods led to excessively high growth rates in consumer prices:

Indeed, the recent inflationary episode is the exception, not the norm. So if increasing the federal debt has not historically led to an accelerated increase in CPI, why is this time different? There are myriad reasons for this, including the fact that we were going through a global pandemic, temporarily shut down the economy, then reopened it, and are dealing with the consequences. Supply chains have completely blown up. Chip shortages are restricting production of new automobiles by the OEMs. Americans consumed an unusually high amount of goods relative to services. Our national infrastructure is generally degrading thanks to multiple decades of underinvestment. None of this has anything to do with the level of federal debt outstanding.

Cochrane goes on to promote his upcoming book, The Fiscal Theory of the Price Level, in which he will apparently claim that inflation happens when the government borrows more money than people expect it to repay. If this sounds like complete nonsense, that's because it is. First of all, as per the 14th Amendment, the US federal government is required by law to repay all of its debts outstanding. Second, generally speaking people don't spend their time assessing the "creditworthiness" of the US federal government. The yield on US Treasuries are called the "risk-free rate" for a reason. The federal government has no limits on its ability to meet obligations denominated in its own currency. If you talk to any actual business owner in real life, most of them won't even be able to tell you how much debt outstanding there is ($30 trillion). Frankly, most of them probably won't be able to recite our nation's annual GDP! ($24 trillion). And that's among people who work in business. Does this guy actually think that non-business people spend time thinking about whether the US can "pay back" its debt? It's an utterly delusional assertion. The only people who talk about this stuff are economists and people in finance. Participants in the "real" economy don't actually know or care. Most people spend time thinking about how to pay their bills, feed their families, engage in extracurricular activities, and take care of their loved ones. The idea that consumers adjust the price they are willing to pay for goods and services based on their perception of the government's capacity to service its debt is absurd. I am embarrassed on the WSJ's behalf for publishing such drivel.

But that's not the only example of Cochrane conjuring fairytales in lieu of the real world. He likens the US Government's stimulus package to Milton Friedman's infamous "helicopter drop." I don't know about you, but I don't recall seeing bags of dollar bills being dropped from magic helicopters a year ago. In the real world, in the United States of America, on Planet Earth, money is created when either the US federal government spends more than it collects in taxes, or when banks create new loans. These new dollars are simultaneously assets and liabilities. Cochrane's analogy of a magic money helicopter is not only silly, it's also just the completely wrong. It implies that money appears out of nowhere, existing as a fixed stock of a scarce, commodity-like resource. It's as if cash exists only as an asset. In reality, we know that the cash in our pockets is our asset, and simultaneously a liability of the Federal Reserve. Cochrane, and those of his ilk, fail to understand this, and rather than engage in serious, useful discourse, instead resort to fantasies, fairytales, fables, and frauds.

Cochrane claims that when the government issues too much debt, people sell said debt to "buy other things," thus driving up the price of everything. This is just an asinine assertion. Cochrane doesn't seem to be much of a markets guy, so perhaps he doesn't understand that every sale has a purchaser. If "everyone" knows that the government has issued too much debt, and this has led the price of everything else to go up, why on earth would there be any buyers? It's just a ridiculous claim to make. It's also worth noting that people generally buy Treasury securities because it is a safe place to park one's savings. That is money that is put aside for future spending. Why would the government issuing additional debt compel people to all of a sudden spend away their savings? None of this makes any sense.

Let's pretend for a second that MMT is wrong, and that the US federal government does indeed need to "borrow" money from the private sector to fund its deficits. Even if this were true, it's noteworthy that, as Cochrane points out, the US national debt has increased by 30% since the beginning of the pandemic (> 30% since mid-2019). So, nearly 2.5 years after increasing its debt by > 30%, and inflation reaching 7.5%, logically one would expect the interest cost on such debt to be higher, right? As it turns out, the yield on the 10-year Treasury is almost exactly where it was back in mid-2019:

It's these types of thought experiments that compelled me to question conventional economic theory, and eventually embrace MMT. After all, if your theory can't explain and/or predict reality, then what good does it do? Nearly everyone on Wall Street laments how interest rates "should be" higher. This reflects the disconnect between how they think the economy and public finance works versus how it actually works. They stick to their dogma, rather than being open-minded and realizing that orthodox economics is wrong. They are modern-day flat-earthers, convinced their worldview is correct despite all evidence proving otherwise.Their ignorance creates our opportunities.

Before wrapping this post up, I wanted to share two data points which support assertions made in our previous post. Specifically, we wrote the following:

"...by far the most consensus trade for HFs has been “long growth, short value.” So, as reserves were transferred out of the banking system, margin lenders were forced to call in their loans, forcing HFs to de-gross their portfolios. By de-grossing, they sold their “growth” stock longs and covered their “value” stock shorts."

The folks over at Grant's Interest Rate Observer agree that, per FINRA, a substantial de-grossing has taken place as margin balances are falling off a cliff (emphasis added):

"As stocks rolled over to start the year, domestic margin debt collapsed by a record $85 billion in January vs. the previous month, data from the Financial Industry Regulatory Authority show. Despite that downward lurch, the outstanding $830 billion figure at the end of January compares to $799 billion a year ago and sits far above the $562 billion in January 2020, before the bug barged in." (source: Almost Daily Grant's https://www.grantspub.com/resources/commentary.cfm)

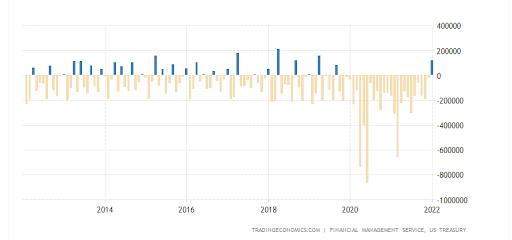

How they don't make the connection that the largest contraction on margin debt ever coincided with one of the largest treasury surplus months ever is beyond me.

And, per Goldman Sachs, hedge funds have generally performed terribly, because as stated, they have all piled into the same long growth/short value trades: